Property Taxes In Cedar Rapids Iowa . Linn county makes no warranties,. By mailing payment to linn county treasurer. the property tax division is responsible for collecting taxes for real estate property, mobile homes, utilities, computer equipment, industrial machinery, bushels of grain,. If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of. This application was developed using esri arcgis experience builder. property tax payments can be completed in the following ways: By mailing payment to linn county treasurer. This process involves multiple departments from the city of cedar rapids and linn county, including:. below are the various steps taken to generate a tax bill for a property. you can apply for your homestead tax credit online! property tax payments can be completed in the following ways: linn county, iowa tax search. the recently updated tax estimator calculates using the 2024 assessed value and the most recent levy rates and rollbacks. the city of cedar rapids has primarily three categories of taxes:

from www.istockphoto.com

By mailing payment to linn county treasurer. the recently updated tax estimator calculates using the 2024 assessed value and the most recent levy rates and rollbacks. property tax payments can be completed in the following ways: the city of cedar rapids has primarily three categories of taxes: Linn county makes no warranties,. property tax payments can be completed in the following ways: you can apply for your homestead tax credit online! This application was developed using esri arcgis experience builder. By mailing payment to linn county treasurer. If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of.

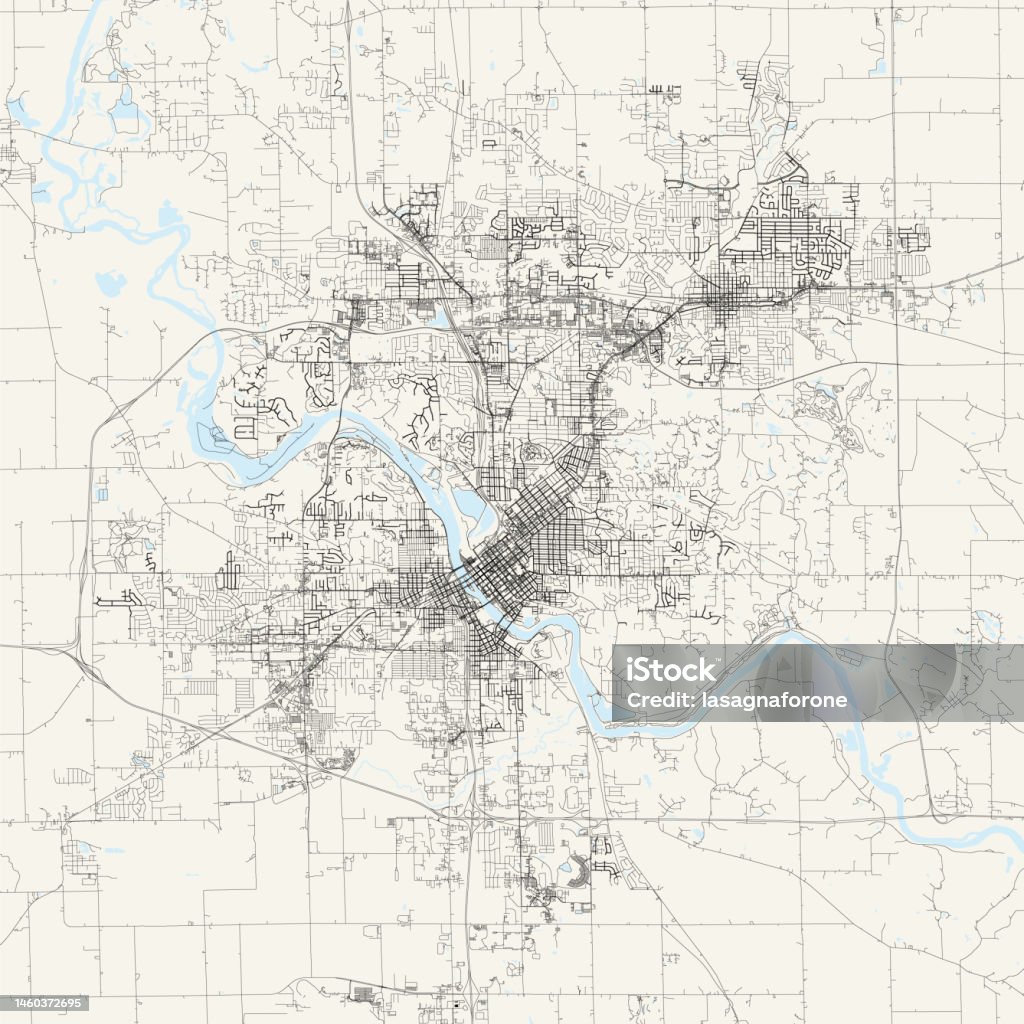

Cedar Rapids Iowa Usa Vector Map Stock Illustration Download Image

Property Taxes In Cedar Rapids Iowa the city of cedar rapids has primarily three categories of taxes: linn county, iowa tax search. you can apply for your homestead tax credit online! the city of cedar rapids has primarily three categories of taxes: property tax payments can be completed in the following ways: property tax payments can be completed in the following ways: below are the various steps taken to generate a tax bill for a property. This application was developed using esri arcgis experience builder. By mailing payment to linn county treasurer. By mailing payment to linn county treasurer. the property tax division is responsible for collecting taxes for real estate property, mobile homes, utilities, computer equipment, industrial machinery, bushels of grain,. Linn county makes no warranties,. If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of. This process involves multiple departments from the city of cedar rapids and linn county, including:. the recently updated tax estimator calculates using the 2024 assessed value and the most recent levy rates and rollbacks.

From www.gobankingrates.com

10 Worst Places in Iowa for a Couple To Live on Only Social Security Property Taxes In Cedar Rapids Iowa property tax payments can be completed in the following ways: By mailing payment to linn county treasurer. This application was developed using esri arcgis experience builder. the property tax division is responsible for collecting taxes for real estate property, mobile homes, utilities, computer equipment, industrial machinery, bushels of grain,. below are the various steps taken to generate. Property Taxes In Cedar Rapids Iowa.

From www.worldatlas.com

7 Most Charming Cities In Iowa WorldAtlas Property Taxes In Cedar Rapids Iowa property tax payments can be completed in the following ways: Linn county makes no warranties,. the property tax division is responsible for collecting taxes for real estate property, mobile homes, utilities, computer equipment, industrial machinery, bushels of grain,. linn county, iowa tax search. This process involves multiple departments from the city of cedar rapids and linn county,. Property Taxes In Cedar Rapids Iowa.

From sellhousefast.com

Sell Your House Fast in Cedar Rapids, IA Property Taxes In Cedar Rapids Iowa property tax payments can be completed in the following ways: property tax payments can be completed in the following ways: the property tax division is responsible for collecting taxes for real estate property, mobile homes, utilities, computer equipment, industrial machinery, bushels of grain,. By mailing payment to linn county treasurer. This process involves multiple departments from the. Property Taxes In Cedar Rapids Iowa.

From www.expedia.ca

Visit Cedar Rapids Iowa City Best of Cedar Rapids Iowa City Property Taxes In Cedar Rapids Iowa linn county, iowa tax search. By mailing payment to linn county treasurer. If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of. the property tax division is responsible for collecting taxes for real estate property, mobile homes, utilities, computer equipment, industrial machinery, bushels of grain,. This application was developed using. Property Taxes In Cedar Rapids Iowa.

From www.wdm.iowa.gov

Property Taxes West Des Moines, IA Property Taxes In Cedar Rapids Iowa By mailing payment to linn county treasurer. This application was developed using esri arcgis experience builder. This process involves multiple departments from the city of cedar rapids and linn county, including:. If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of. below are the various steps taken to generate a tax. Property Taxes In Cedar Rapids Iowa.

From www.neilsberg.com

Cedar Rapids, IA Median Household By Race 2024 Update Neilsberg Property Taxes In Cedar Rapids Iowa If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of. This process involves multiple departments from the city of cedar rapids and linn county, including:. Linn county makes no warranties,. you can apply for your homestead tax credit online! By mailing payment to linn county treasurer. the property tax division. Property Taxes In Cedar Rapids Iowa.

From local.thegazette.com

Drury Accounting & Tax Cedar Rapids Gazette Property Taxes In Cedar Rapids Iowa By mailing payment to linn county treasurer. This application was developed using esri arcgis experience builder. If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of. This process involves multiple departments from the city of cedar rapids and linn county, including:. below are the various steps taken to generate a tax. Property Taxes In Cedar Rapids Iowa.

From www.istockphoto.com

Cedar Rapids Iowa Usa Vector Map Stock Illustration Download Image Property Taxes In Cedar Rapids Iowa By mailing payment to linn county treasurer. below are the various steps taken to generate a tax bill for a property. property tax payments can be completed in the following ways: This process involves multiple departments from the city of cedar rapids and linn county, including:. you can apply for your homestead tax credit online! property. Property Taxes In Cedar Rapids Iowa.

From www.facebook.com

Affordable Tax Preparation and Accounting Cedar Rapids IA Property Taxes In Cedar Rapids Iowa the city of cedar rapids has primarily three categories of taxes: This application was developed using esri arcgis experience builder. linn county, iowa tax search. below are the various steps taken to generate a tax bill for a property. If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of.. Property Taxes In Cedar Rapids Iowa.

From cbs2iowa.com

Cedar Rapids metro communities approve 10year sales tax extension Property Taxes In Cedar Rapids Iowa you can apply for your homestead tax credit online! If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of. By mailing payment to linn county treasurer. the property tax division is responsible for collecting taxes for real estate property, mobile homes, utilities, computer equipment, industrial machinery, bushels of grain,. This. Property Taxes In Cedar Rapids Iowa.

From exozqzefc.blob.core.windows.net

Johnson County Iowa Property Tax Payment at Patsy Meisner blog Property Taxes In Cedar Rapids Iowa the city of cedar rapids has primarily three categories of taxes: This process involves multiple departments from the city of cedar rapids and linn county, including:. property tax payments can be completed in the following ways: By mailing payment to linn county treasurer. linn county, iowa tax search. property tax payments can be completed in the. Property Taxes In Cedar Rapids Iowa.

From www.youtube.com

Iowa's Property Taxes Have Increased for 20 Straight Years YouTube Property Taxes In Cedar Rapids Iowa the recently updated tax estimator calculates using the 2024 assessed value and the most recent levy rates and rollbacks. Linn county makes no warranties,. By mailing payment to linn county treasurer. property tax payments can be completed in the following ways: This process involves multiple departments from the city of cedar rapids and linn county, including:. below. Property Taxes In Cedar Rapids Iowa.

From www.facebook.com

Thomasville Leather Sofa Sofas, Loveseats & Sectionals Cedar Rapids Property Taxes In Cedar Rapids Iowa linn county, iowa tax search. you can apply for your homestead tax credit online! If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of. below are the various steps taken to generate a tax bill for a property. the city of cedar rapids has primarily three categories of. Property Taxes In Cedar Rapids Iowa.

From cbs2iowa.com

Deadline to pay property taxes extended in Iowa Property Taxes In Cedar Rapids Iowa linn county, iowa tax search. the city of cedar rapids has primarily three categories of taxes: below are the various steps taken to generate a tax bill for a property. you can apply for your homestead tax credit online! By mailing payment to linn county treasurer. This application was developed using esri arcgis experience builder. . Property Taxes In Cedar Rapids Iowa.

From www.iowapublicradio.org

Cedar Rapids To Raise Property Taxes To Fund Flood Protection Iowa Property Taxes In Cedar Rapids Iowa If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of. the city of cedar rapids has primarily three categories of taxes: linn county, iowa tax search. the property tax division is responsible for collecting taxes for real estate property, mobile homes, utilities, computer equipment, industrial machinery, bushels of grain,.. Property Taxes In Cedar Rapids Iowa.

From www.pinterest.com

Floor Charts Iowa, Cedar rapids, Rod Property Taxes In Cedar Rapids Iowa linn county, iowa tax search. below are the various steps taken to generate a tax bill for a property. you can apply for your homestead tax credit online! the recently updated tax estimator calculates using the 2024 assessed value and the most recent levy rates and rollbacks. This application was developed using esri arcgis experience builder.. Property Taxes In Cedar Rapids Iowa.

From iowatorch.com

New report says Iowa's property taxes are 10th highest in U.S. The Property Taxes In Cedar Rapids Iowa you can apply for your homestead tax credit online! linn county, iowa tax search. property tax payments can be completed in the following ways: By mailing payment to linn county treasurer. If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of. the property tax division is responsible for. Property Taxes In Cedar Rapids Iowa.

From gerdaysaundra.pages.dev

When Is Tax Free Weekend 2024 In Iowa Rica Venita Property Taxes In Cedar Rapids Iowa If you are a homeowner who occupies your permanent residence in linn county, outside the city limits of. By mailing payment to linn county treasurer. This process involves multiple departments from the city of cedar rapids and linn county, including:. the recently updated tax estimator calculates using the 2024 assessed value and the most recent levy rates and rollbacks.. Property Taxes In Cedar Rapids Iowa.